Elected officials and members of the public are often surprised by the answer when they ask UCLA students about how much debt they expect to be dealing with once they graduate.

MYTH: Students cannot afford to attend UCLA as undergraduates, and they leave the university drowning in debt.

THE FACTS

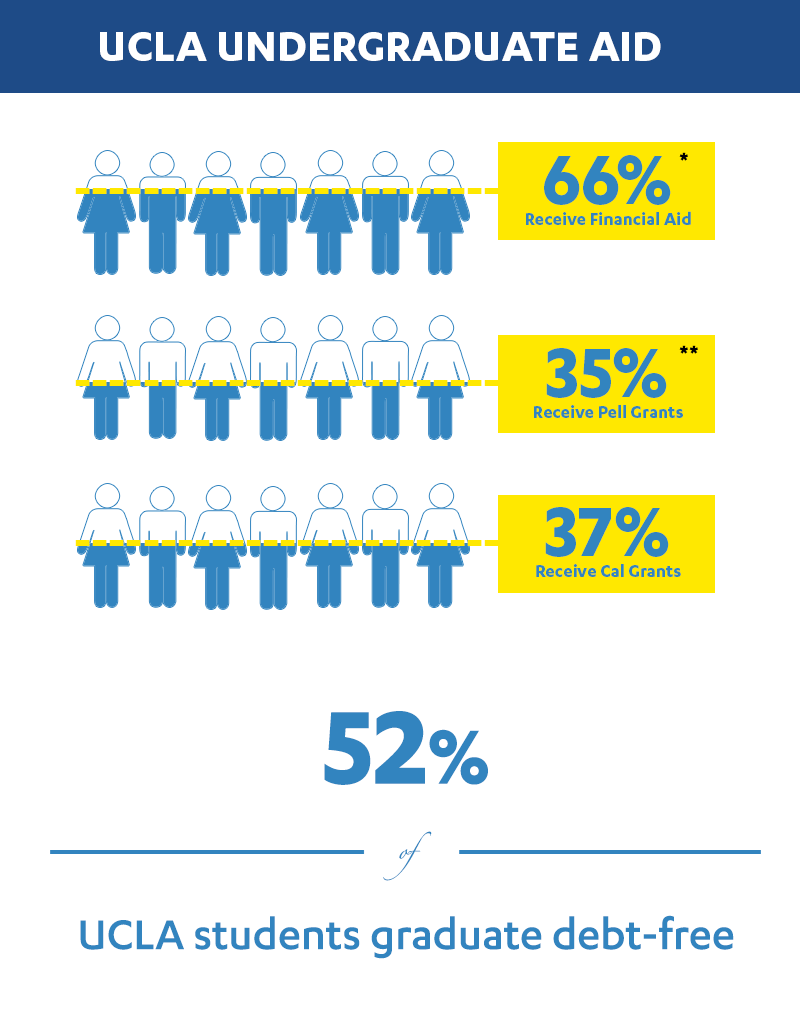

A socioeconomically diverse UCLA undergraduate student body leaves the university with some of the lowest debt in the nation, and with an education that is considered one of the best values in the country.

• The majority of UCLA students receive a combination of scholarships and loans in order to keep their debt manageable.

* Financial aid is defined as a combination of grants, loans and work-study.

**Most Pell Grant Recipients are from households earning $30,000 or less.

• Those who receive financial aid average $22,000 annually.

• UCLA students have a Federal Loan Default Rate of 1.5 percent

• Fall 2015: 38 percent of admitted students came from low-income families and 30 percent will be first in their family to graduate from a four-year college.

• UCLA continues to be considered one of the best values in all of America for a public institution, rating highly on the White House’s College Scorecard and the 2016 Best College Values ranking published by Kiplinger Personal Finance.

• With less student debt obligations, UCLA students can be open to a larger range of postgraduate opportunities, enabling them to consider professions that give back to the community, such as careers in education, government and public service.